IN ST-103 2007-2026 free printable template

Show details

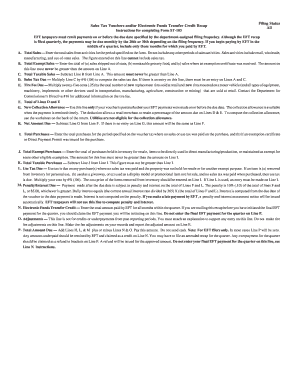

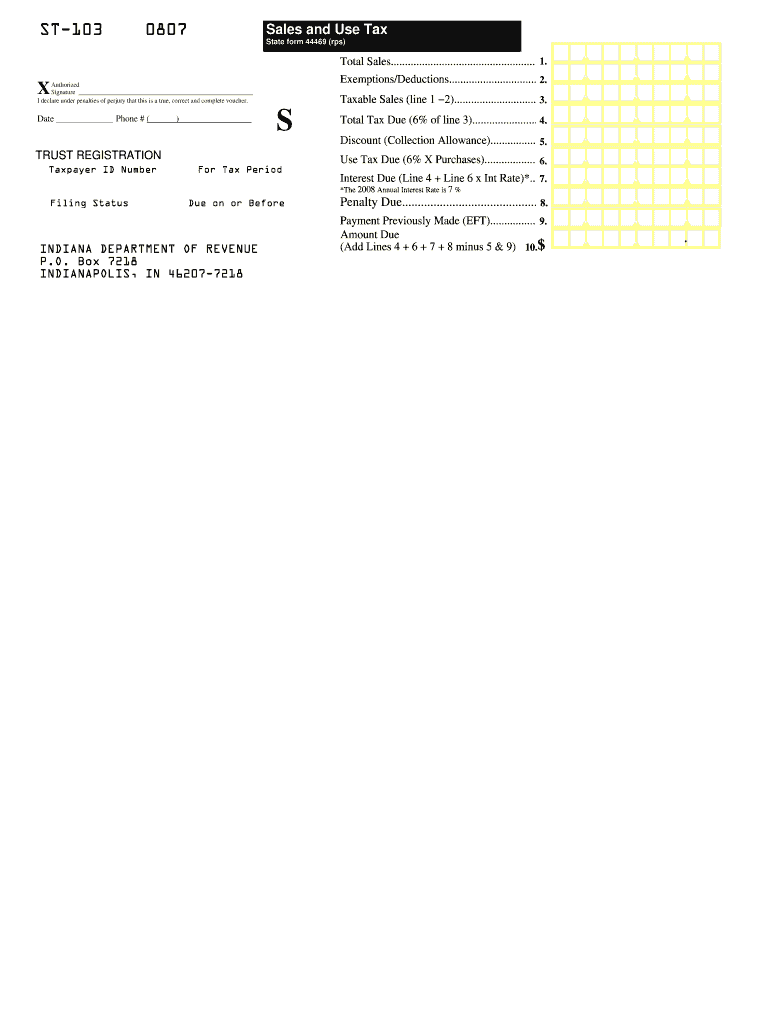

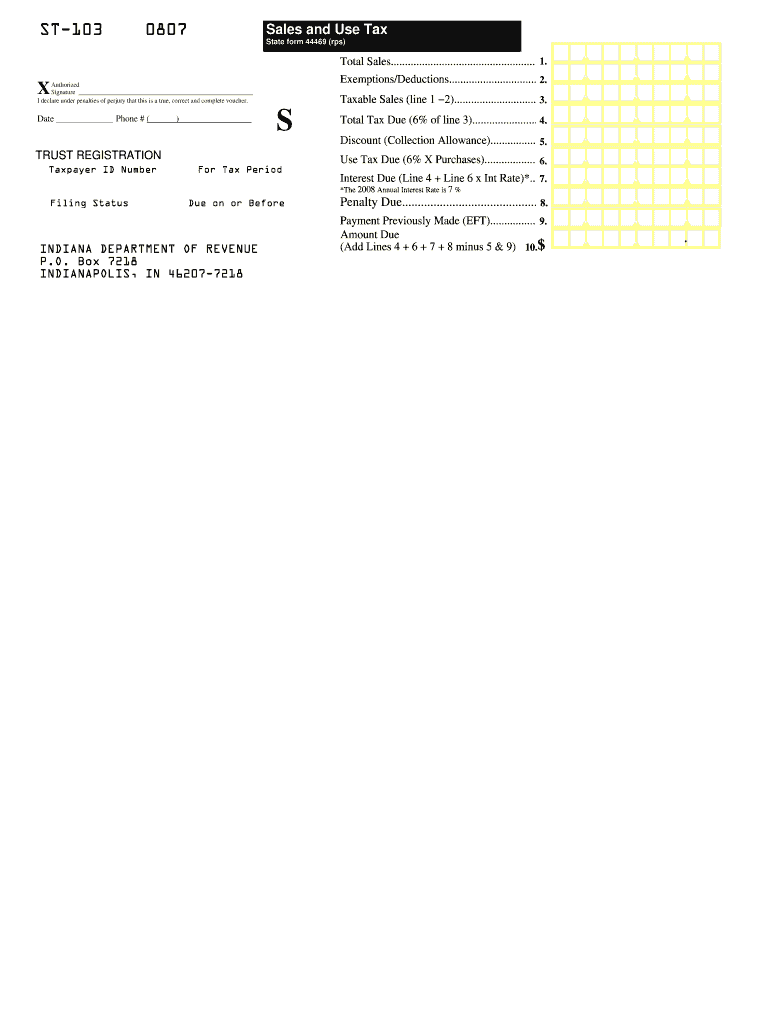

ST-103 0807 Sales and Use Tax State form 44469 (rps), Exemptions/Deductions................................2. , Taxable Sales (line 1 ?2)............................. 3. , Total Tax Due (6% of line

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign st 103 form

Edit your st 103 indiana form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st103 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing st103 form online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit what is in st 103 types of purchases or transactions form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN ST-103 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out pdffiller form

How to fill out IN ST-103

01

Obtain the IN ST-103 form from the state tax office website or local office.

02

Fill in your personal information, including your name, address, and tax identification number.

03

Specify the type of tax or exemption you are applying for.

04

Carefully read the instructions provided at the beginning of the form.

05

Complete all required fields, ensuring accuracy in your entries.

06

Sign and date the form to certify that the information provided is true and correct.

07

Submit the completed form either online or by mailing it to the appropriate tax authority.

Who needs IN ST-103?

01

Individuals or businesses seeking a tax exemption in the state.

02

Taxpayers who need to provide documentation for specific tax credits.

03

Any entity required to report certain tax information as mandated by the state.

Fill

businesses and organizations that qualify to document their exempt status

: Try Risk Free

People Also Ask about st 103 form

How long is an Indiana sales tax exemption good for?

Tax exemption certificates last for one year in Alabama and Indiana. Certificates last for five years in at least 9 states: Florida, Illinois, Kansas, Kentucky, Maryland, Nevada, Pennsylvania, South Dakota, and Virginia.

Does Indiana sales tax exemption expire?

There is typically no fee to renew an exemption. Of the 11 states, all but two (Alabama and Indiana) exempt entities for five year periods.

What qualifies for tax exempt in Indiana?

While the Indiana sales tax of 7% applies to most transactions, there are certain items that may be exempt from taxation. This page discusses various sales tax exemptions in Indiana.Other tax-exempt items in Indiana. CategoryExemption StatusFood and MealsMachineryEXEMPTRaw MaterialsEXEMPTUtilities & FuelEXEMPT19 more rows

What qualifies for sales tax exemption in Indiana?

While the Indiana sales tax of 7% applies to most transactions, there are certain items that may be exempt from taxation. This page discusses various sales tax exemptions in Indiana.Other tax-exempt items in Indiana. CategoryExemption StatusFood and MealsMachineryEXEMPTRaw MaterialsEXEMPTUtilities & FuelEXEMPT19 more rows

Does a exemption certificate expire?

Certificates are valid for up to three years.

What is an ST 103 form Indiana?

IN ST-103 Information All Businesses in Indiana must file for any sales activities include retail, wholesale, manufacturing, and out?of- state sales. Use tax is due on any purchase(s) where no sales tax was paid and the property was not held for resale or for another exempt purpose.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete what is the purpose of sales tax exemption in indiana on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your register for sales tax in indiana. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I edit tax exempt form indiana on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as indiana retail merchant certificate. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

How do I complete 103 indiana on an Android device?

Complete your indiana sales tax exempt form and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is IN ST-103?

IN ST-103 is a form used by businesses in Indiana to claim an exemption from sales tax for certain types of purchases or transactions.

Who is required to file IN ST-103?

Businesses and organizations that qualify for sales tax exemptions in Indiana are required to file IN ST-103 to document their exempt status.

How to fill out IN ST-103?

To fill out IN ST-103, provide accurate information regarding the purchaser, the nature of the exemption, and details of the transaction, ensuring all required fields are completed.

What is the purpose of IN ST-103?

The purpose of IN ST-103 is to formally document and verify a purchaser's eligibility for a sales tax exemption in Indiana.

What information must be reported on IN ST-103?

IN ST-103 must report information such as the purchaser's name, address, tax identification number, the reason for exemption, and the specific items being purchased.

Fill out your IN ST-103 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indiana Tax Exempt Form Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to form 103

Related to 103 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.