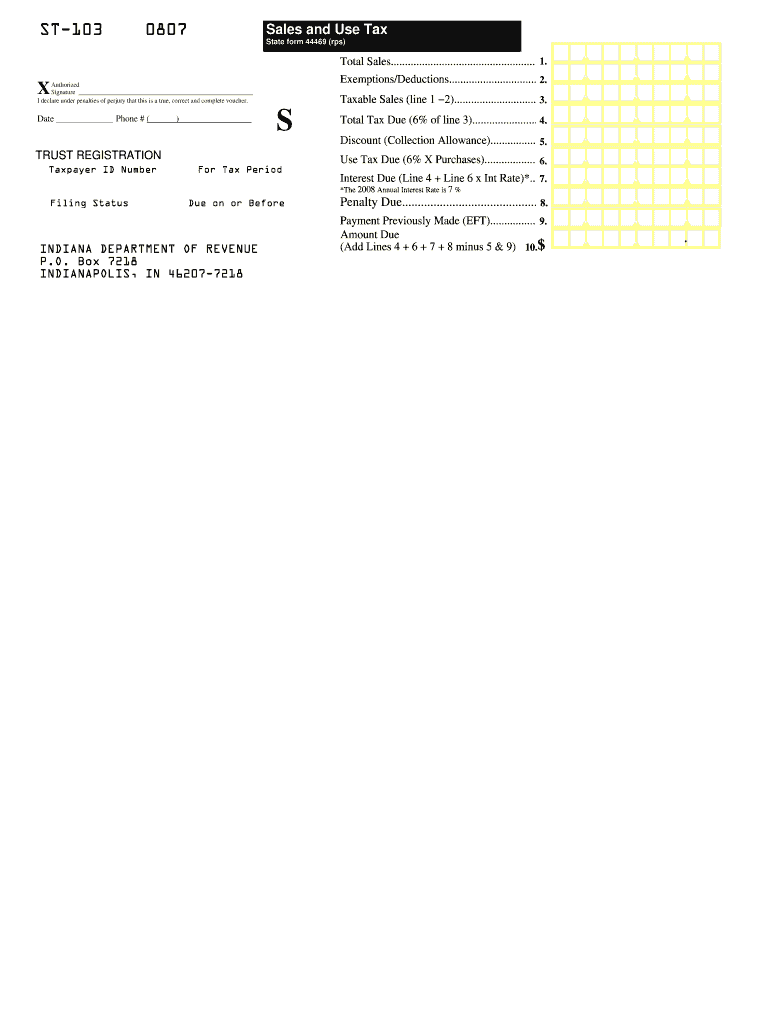

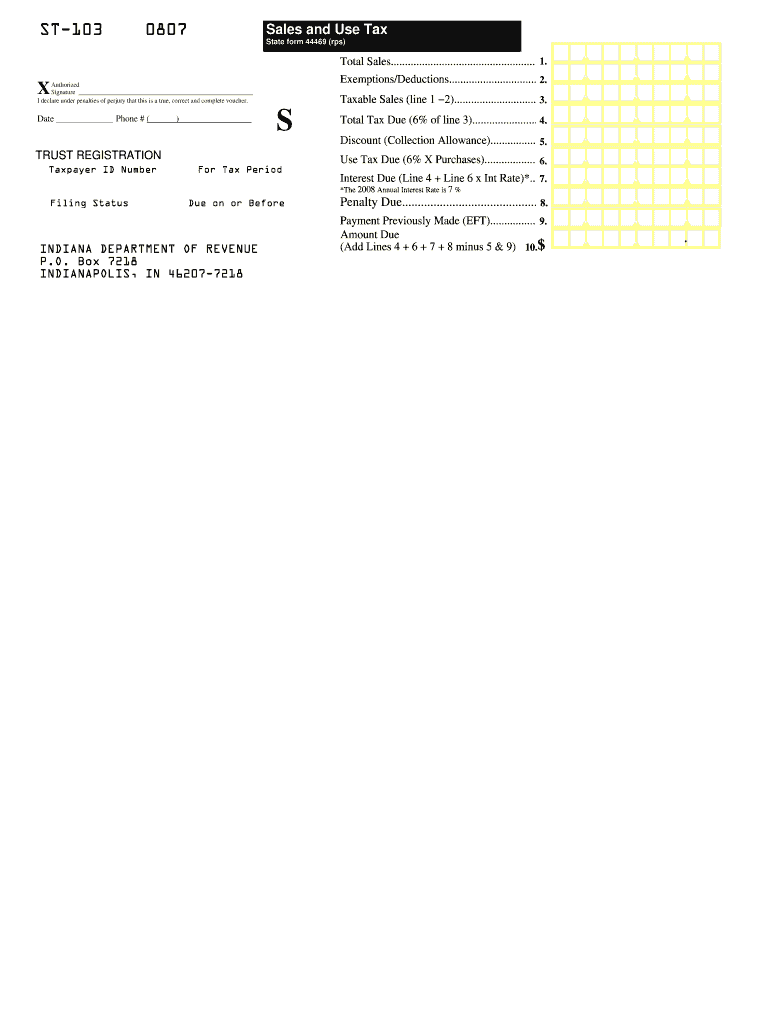

IN ST-103 2007-2024 free printable template

Get, Create, Make and Sign

Editing st 103 form online

IN ST-103 Form Versions

How to fill out st 103 form 2007-2024

Video instructions and help with filling out and completing st 103 form

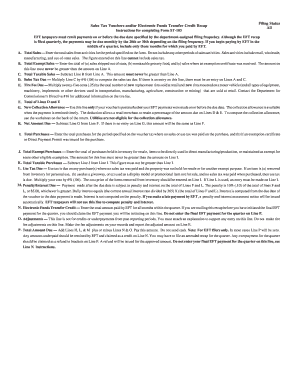

Instructions and Help about indiana sales tax form st 103

Everyone this is Blake with warren and wound, and today we're going to be taking a look at the sin flagger chronograph 103 now this is the most sort of classically and simply designed of the 103 watches that sin currently has available with polished stainless steel case and domed acrylic crystal this particular model also features a boundary 775 o movement and aesthetically really hardens back to classic pilot chronograph to the 1960s and as well as the Underwear watches that sin was had a hand in producing in the 1960s as well, so this watch currently retails for eighteen hundred and eighty dollars so let's take a closer look okay, so now we're going to take a closer look at the case of the 103 this case is modestly sized and measures 41 millimeters in diameter 47 millimeters lug to log in as a 20 millimeter lug width, and it also measures 15 millimeters tall approximately with the don't acrylic crystal aesthetically speaking its sort of very true to the pilot corona graphs the 1960s with specifically with the case in the bezel and so some characteristics that you're going to see in those older watches in with this is this sort of angular lug that points down towards the bracelet as well as this beveling along the edge of the lugs here there's also the polished case which is consistent, and you know again one of the primary characteristics of course is bezel it's this bi-directional pilots bezel it's a black alloy and again this particular bezel is very true to the style of those that you'd find and sort of more vintage pilot corona graphs you see here there's the crown at three o'clock with the crown guards and now moving to the side again you can see that 15 millimeter thick case which has made a little thicker by this domed acrylic crystal give the signed crown here with the sin s and then of course you can see the polished throne pushers and the polishing does continue along the side of the case but ends on the back here does this brushed stainless steel screw down case back and the very sort of like aggressive angular lines of the case I think are also very apparent here it makes for a comfortable wear with the lugs hugging your wrist as you wear it but again just sort of it's very consistent with the pilot chronograph to the 1960s but also just gives it you know it really sort of drives home that more masculine geometric aesthetic that you're looking forward to watch with this type and then if we just turn it toward the back here you can see the screw down polished or sees me the brushed stainless steel case back with some information about the watch and the brand name etc we're going to get a nice close-up look at the dial of the 103 so obviously the static of it is well dictated by the fact that it's powered by a value 775 though obviously the workhorse a Swiss automatic chronograph movement it's 25 joules be 220 80 beats per hour, and I'll actuate here, so you can see how it functions, so obviously you have the active second hands here...

Fill how to fill out form st 103 : Try Risk Free

People Also Ask about st 103 form

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your st 103 form 2007-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.